Mobile Health Industry Trends and Forecast 2021

First things first: what is mHealth? Mobile health or mHealth covers healthcare services provided via mobile apps, wearables, etc. Typical applications of mHealth include personal health monitoring and tracking, fitness, chronic illness tracking, and many others.

At Artezio, Healthcare is one of our main areas of interest and expertise. Based on our observations and practice in building Healthcare apps, mHealth is seeing rapid growth due to:

- The ever-growing and increasingly more savvy smartphone user base projected to reach 7.5 billion users in 2026

- Cost reduction both for service providers and customers, eliminating downtime and travel

- Continuous introduction of new (and more advanced) wearable medical devices that are seeing growing adoption and use globally

- Necessity due to COVID-19 that is far from being over and will likely continue to be present for years to come

- The maturity of underlying technologies including AI, machine learning, DNA sequencing, as well as the wider implementation of electronic health records and other standards.

Let’s take a look at the market data and see what kind of conclusions we can draw from this trend (given the uncertainty the market is experiencing at the moment).

mHealth Industry Trends

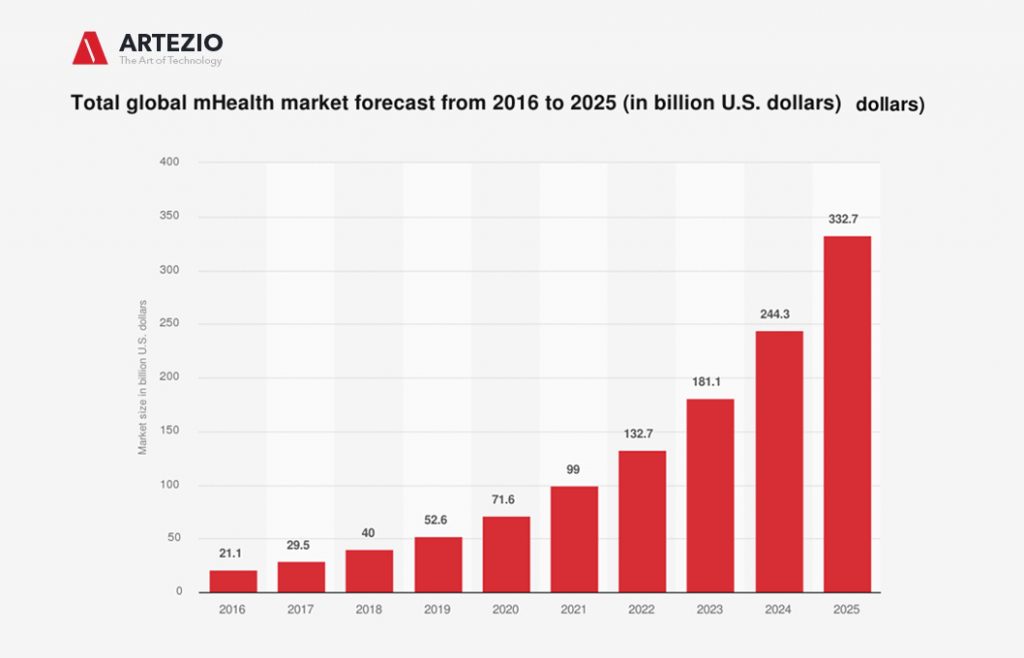

In short, mHealth is projected to keep growing, seeing more and more active users globally. In 2020, the market size for mHealth was valued at over $45 billion. The COVID-19 outbreak, however, triggered a drastic surge in market size, which is now projected to reach $100 billion (Statista) by the end of 2021 – a fivefold increase from $21 billion in 2016. North America was the dominant regional market in 2020 and accounted for a revenue share of 38.8%.

Total global mHealth market forecast from 2016 to 2025:

What are the major market drivers?

- Rising use of smartphones, specialized apps, and other wireless infrastructure across the globe

- Growing cases of chronic diseases

- Great potential for cost-saving in healthcare delivery

- Rising adoption of smart wearable medical devices

- Favorable government initiatives

- Increased adoption during COVID-19 pandemic

How many people actively use smartphones worldwide?

Today (as of July 2021), this number hovers at around 6 billion and is forecast to further grow by several hundred million in the next few years. China, India, and the United States are the countries with the highest number of smartphone users.

The United States had one of the highest smartphone usage rates in the world, with 81.6% of the population using a smartphone as of September 2020.

Outside Western Europe and the United States, smartphone usage is the highest in South Korea, as more than 76% of the population uses a smartphone. Japan is a notable exception to the 70% line, with penetration rates just under 60%.

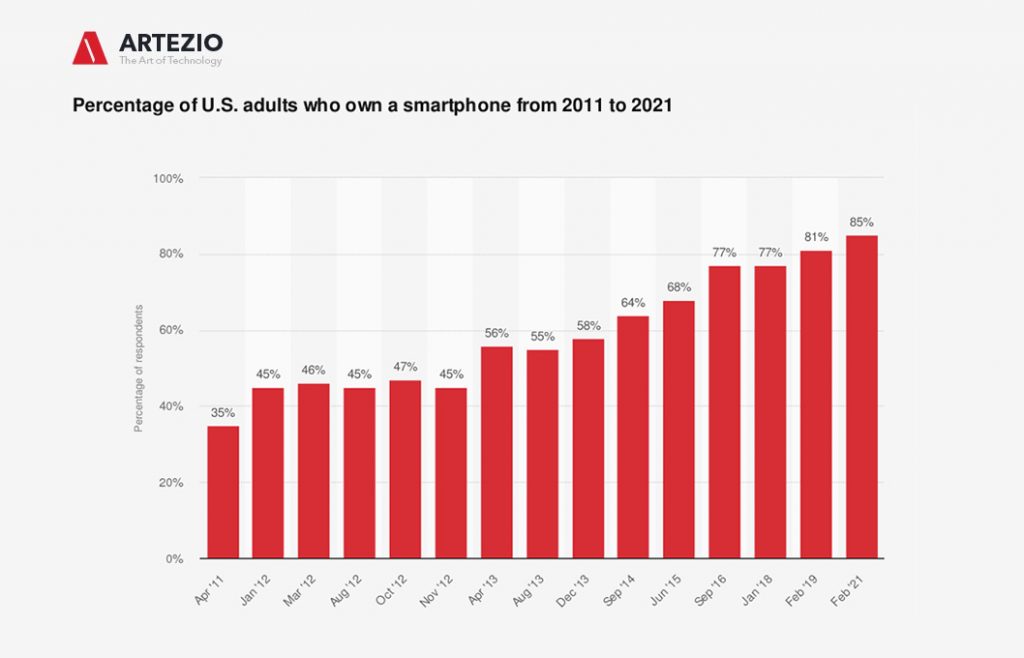

Percentage of U.S. adults who own a smartphone from 2011 to 2021

The percentage of U.S. adults who own a smartphone has more than doubled since 2011. Only 35% of all U.S. adults owned a smartphone in 2011, compared to 85% of adults who owned a smartphone, as of February 2021. The share of U.S. adults owning a smartphone increased by 50% over the highlighted period.

Thus, based on this we can conclude that the smartphone market is more than healthy and mHealth has the opportunity to become increasingly popular.

Current situation with mHealth solutions on the market

Now let’s take a look at healthcare apps in general. In the first quarter of 2020, there were around 53,979 mHealth apps available on the Apple Store and 53,054 healthcare apps at Google Play worldwide.

Worldwide & US mHealth Download Leaders

From the start of COVID-19, the number of healthcare app downloads increased by 65% worldwide and by 30% in the US during its peak month of COVID-19 compared to January 2020.

South Korea had the highest growth, with a 135% increase in downloads comparing its peak month of the pandemic with January.

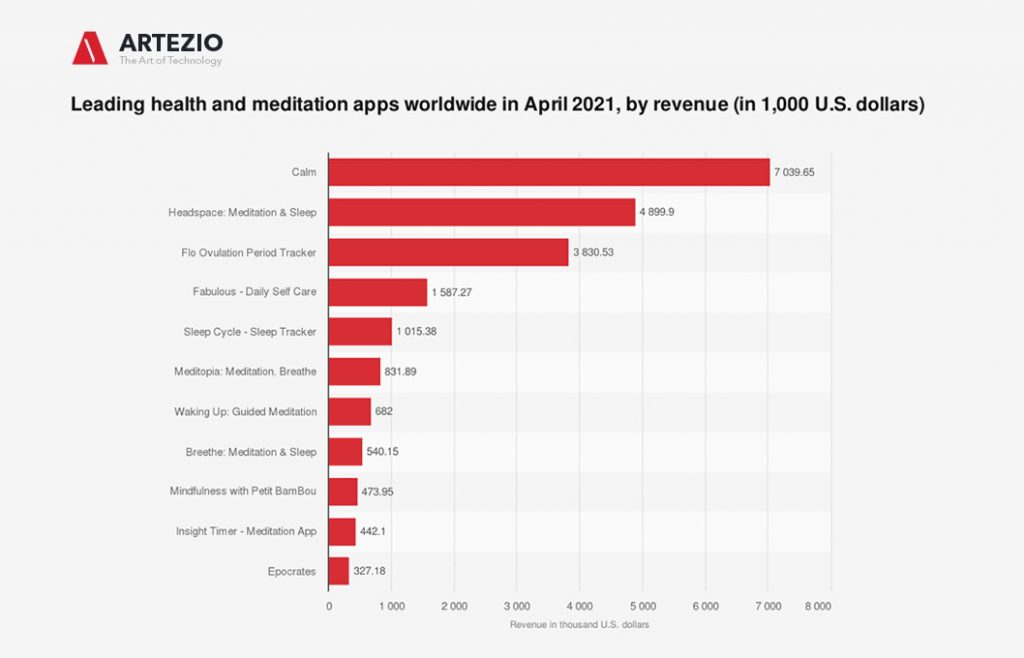

What’s more, the State of Mobile 2021 report demonstrates that the boom in health and fitness apps was sustained throughout the year, while physical workout apps dominated the new app arrivals. Mental health app Calm came top in terms of consumer spending for 2020.

In April 2021, Calm was the highest-grossing meditation and mindfulness app worldwide, with in-app revenues of roughly $7 million in the examined period. Headspace ranked second, generating almost $4.9 million of in-app revenues. Calm offers a limited free trial period before redirecting users towards its subscription options, while Headspace comes with a limited set of free features for non-paying users. Female health app Flo, which generated roughly $3.8 million, also allows non-paying users to take advantage of a limited set of features.

Mental Health apps were top-of-mind this year as we adjusted to our “new normal.” In the U.S. from November 3 to November 5, 2020, the leading mental wellness apps were installed 215,000 times in United States. As of 2020, mental health as the mHealth sector had the highest investments in the United States with $252 million.

Many health and fitness apps are either linked to specific activity trackers, such as Fitbit devices or Apple and Samsung smartwatches. They also provide users with tracking and workouts regardless of other digital devices. During a March 2018 survey, 42% of U.S. adults stated that they used some sort of digital technology to measure fitness and health improvement goals.

Only 8% of US adults over 50 years old said they would share their digitally-tracked health information on social media.

COVID tracker apps are also featured, and that is likely to continue into 2021. With over 150 million downloads, India’s Aarogya Setu is the world’s most downloaded COVID-19 contact tracing app.

In April 2021, Aarogya Setu was the most downloaded health app in the Google Play Store worldwide. The app generated almost 4.3 million downloads from Android users. Co-WIN Vaccinator App was the second-most popular app with approximately 3.1 million downloads from global users.

Within just 13 days of its launch, Aarogya Setu has been downloaded by more than 50 million users and has become the most downloaded app in the world to track Covid-19.

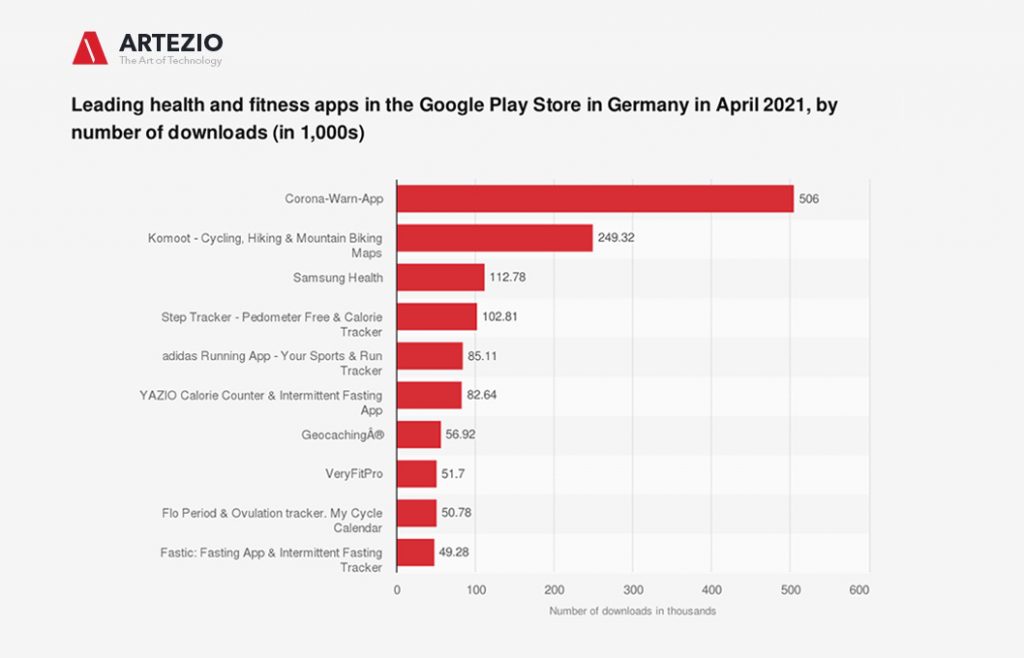

The number one app by number of downloads in Germany was Corona-Warn-App with roughly 506,000 downloads onto German devices according to data published by

Needless to say, the prevalence of mHealth apps and the rising competitive background signal that the demand begins to outpace the supply, thus inciting more and more healthcare businesses to consider their own mHealth solutions and apps.

What awaits the mHealth domain?

Now that we’ve seen that the situation worldwide is ripe for new mHealth solutions to enter the market and help healthcare vendors to provide better, faster, and more efficient healthcare, let’s see what kind of future likely awaits mHealth globally.

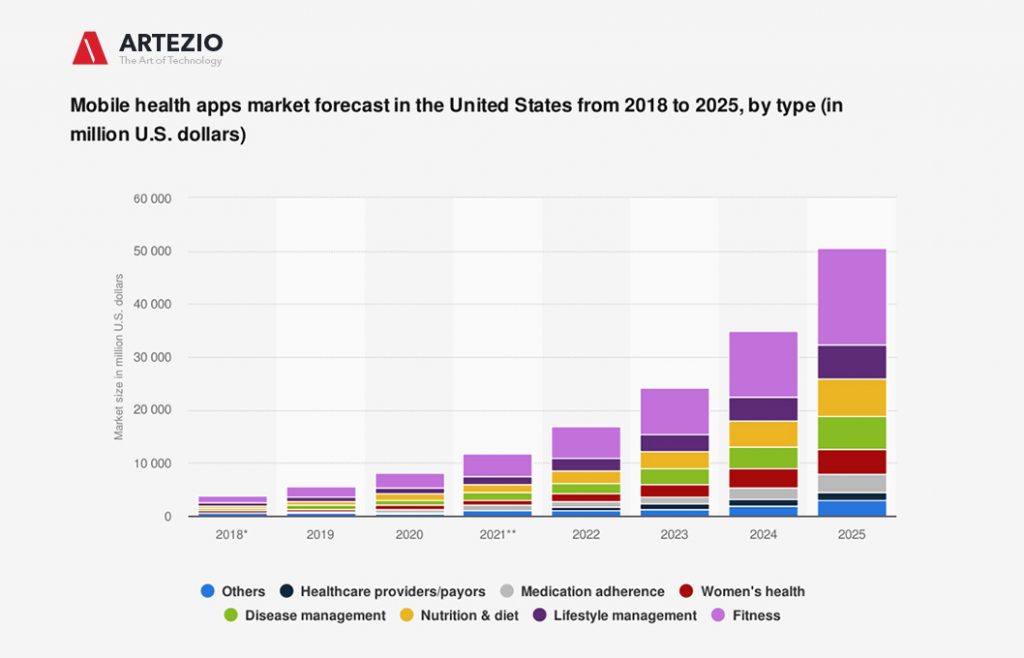

The statistic below displays the projected mobile health apps market size in the United States from 2018 to 2025, by type. The market segment for medication adherence apps is predicted to reach some 3.5 bln. U.S. dollars in 2025.

Mobile health apps market forecast in the United States from 2018 to 2025, by type

Factors like rapid growth in the usage of smartphones, developments in coverage networks, increasing prevalence of chronic diseases, and rise in geriatric population are driving the market growth in North America. In addition, the rising demand for health and analytics solutions has led to increased adoption of such applications by healthcare providers. Increasing cases of chronic conditions requiring remote monitoring and treatment also boost the demand for mobile health platforms.

Industry experts believe that by 2030, mobile apps will have become firmly embedded within standard treatment protocols for the majority of diseases and conditions, and widely used in preventative care. Their adoption will bring many benefits, including improved quality of care, increased patient engagement, and reduced costs. mHealth will at once make healthcare far more personalized and intimate while also providing clinicians with a stronger foundation for scientific evidence-based decision-making.

Some statistics and facts about Healthcare:

- 74% of hospitals are more efficient thanks to mobile devices.

- 43% of physicians use mobile devices to access patients’ data.

- 52% of adults would be willing to conduct a post-surgical visit via video call.

- 74% of consumers say they are open to a virtual health visit.

Conclusion

It should be noted that IT in healthcare is heavily regulated with a whole variety of standards, such as HIPAA, CCPA, GDPR, SOC 2, ISO 27001, and others. It means that if you are looking to kickstart a mHealth solution for your patient base, the healthcare standards must always be considered during the planning stage, as these affect the development process greatly. What’s more, mHealth solutions cover multiple mobile OS systems – Android and iOS being the majority, and proper development of apps for these systems simultaneously require additional resources and planning.

For instance, when it comes to mobile platforms, Apple is the leading vendor in the United States smartphone market with almost 50 percent of U.S. mobile phone subscribers using an Apple device. Although Apple is the leading vendor in the United States, the Apple iOS operating system has a lower market share than its main competitor Google Android. As the Android operating system is used by the vast majority of smartphone vendors other than Apple, it combines the share of popular brands such as Samsung, LG, Lenovo, and others.

At Artezio, we have the necessary experience to develop custom mobile and web-based health maintenance software solutions for clinics, hospitals, nutritionists, and physiotherapy centers, including cross-platform solutions. Our apps also incorporate benefits like inventory management, patient engagement, managing health records, tracking health maintenance products, medical billing, and the understanding of the underlying revenue cycle.

All in all, the industry is booming, and it’s not really a secret. In the future, we can only expect more and more interesting projects to enter the mHealth market and provide new, quality benefits to doctors and patients alike.

Get in touch with us to learn more about mHealth development costs, details, and success cases.

Thank you for reading!