- Services

- Artificial Intelligence Development

- Deep Learning & Neural Network Development Services

- Professional Machine Learning Development Services

- Enterprise Computer Vision Development Services

- Enterprise Natural Language Processing Development Services

- Chatbot & Conversational AI Development Services for Business

- Enterprise Computer Vision Solutions For Healthcare

- Transformative Healthcare AI Development

- Retail & E-commerce AI Solutions for Personalization & Growth

- AI Integration & MLOps Development Services

- AI Agent Development & Intelligent Automation

- Generative AI Solutions

- Outsourced Product Development

- Custom Software Development

- Software Customization & Integration

- Mobile App Development

- Custom Application Development

- Software Architecture Consulting

- Enterprise Application Development

- AI-Powered Documentation Services

- Product Requirements Document Services

- Artificial Intelligence Development

- Industries

- Healthcare Software Development

- Telemedicine Software Development

- Medical Software Development

- Electronic Medical Records

- EHR Software Development

- Remote Patient Monitoring Software Development

- Healthcare Mobile App Development Services

- Medical Device Software Development

- Healthcare Mobile App Development Services

- Patient Portal Development Services

- Practice Management Software Development

- Healthcare AI/ML Solutions

- Healthcare CRM Development

- Healthcare Data Analytics Solutions Development

- Hospital Management System Development | Custom HMS & Healthcare ERP

- Mental Health Software Development Services

- Medical Billing & RCM Software Development | Custom Healthcare Billing Solutions

- Laboratory Information Management System (LIMS) Development

- Clinical Trial Management Software Development

- Pharmacy Management Software Development

- Finance & Banking Software Development

- Retail & Ecommerce

- Fintech & Trading Software Development

- Online Dating

- eLearning & LMS

- Cloud Consulting Services

- Healthcare Software Development

- Technology

- Products

- About

- Contact Us

2021: Pharmaceutical Market Breakdown: Time to Invest in IT?

[lwptoc]

The last couple of years have been nothing but a rollercoaster for businesses around the globe. COVID-19, with its new strains putting another level of risk on, forces the pharmaceutical industry to kick into overdrive in order to tackle everything that is going on right now.

Let’s take a look at the current state of things in the Pharma industry, and see if this data can prove useful when answering the question: are we there yet to make a move and introduce something new, or not?

Some quick facts about the pharmaceutical industry to kick things off:

- Drug count has doubled since 2006

- Top disease in terms of the number of active drugs is breast cancer

- There were 18,582 drugs in the research and production pipeline in 2021.

- Phase III segment dominated the market for clinical trials and accounted for the largest revenue share of 53.2% in 2020.

- Out of the top 20 largest R&D spenders, pharmaceutical companies account for nearly half.

- Pharma company with the highest number of employees worldwide as of 2020 is Johnson & Johnson.

Current outlook on the Industry

The global pharmaceutical market is seeing significant growth, right now and over recent years. COVID-19 has been an extra catalyst to propel it even higher.

- In 2020, there were around 4,800 pharmaceutical companies with active research and development (R&D) pipelines.

- As of end-2020, the total global pharmaceutical market was valued at about 1.27 trillion U.S. dollars. Sales are expected to grow to $1.7 trillion in 2025 at a CAGR of 8%.

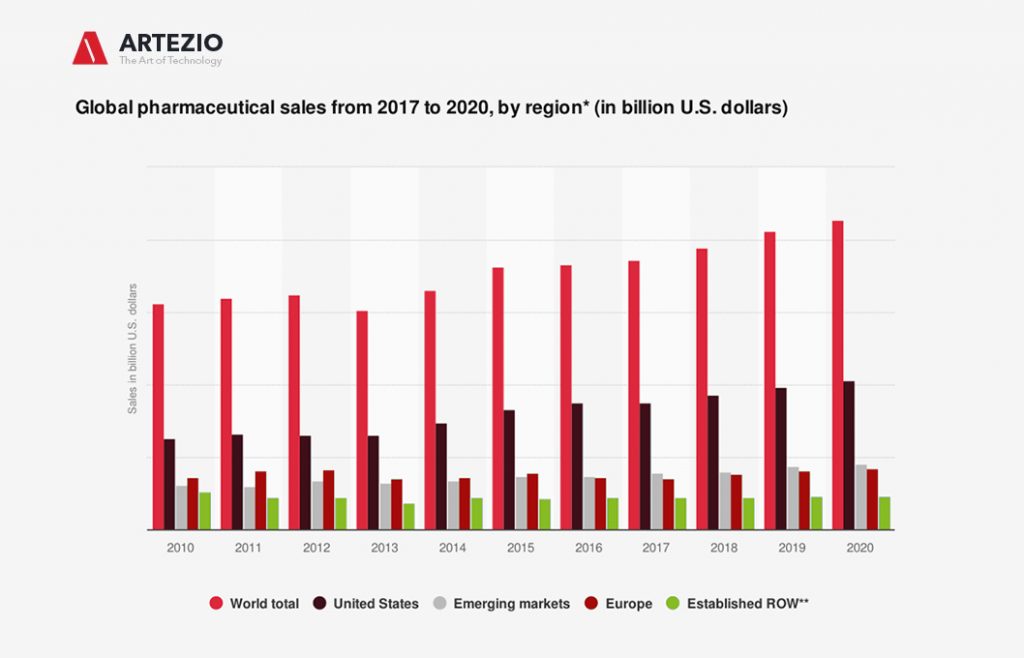

Followed by the group of emerging markets, North America was the largest region in the global pharmaceuticals market. Globally, the United States has emerged as the leading market for pharmaceuticals, accounting for 46% of the market in 2020.

This statistic describes the global pharmaceutical sales from 2017 to Q3 2020, sorted by regional submarkets. As of Q3 2020, total pharmaceutical sales in the United States were estimated to reach around 514 billion U.S. dollars that year.

The best-known top global pharmaceutical companies are Pfizer, Merck, and Johnson & Johnson from the U.S., Novartis, and Roche from Switzerland, and Sanofi from France. North America and Europe keep the lead as the largest global submarkets for pharmaceuticals.

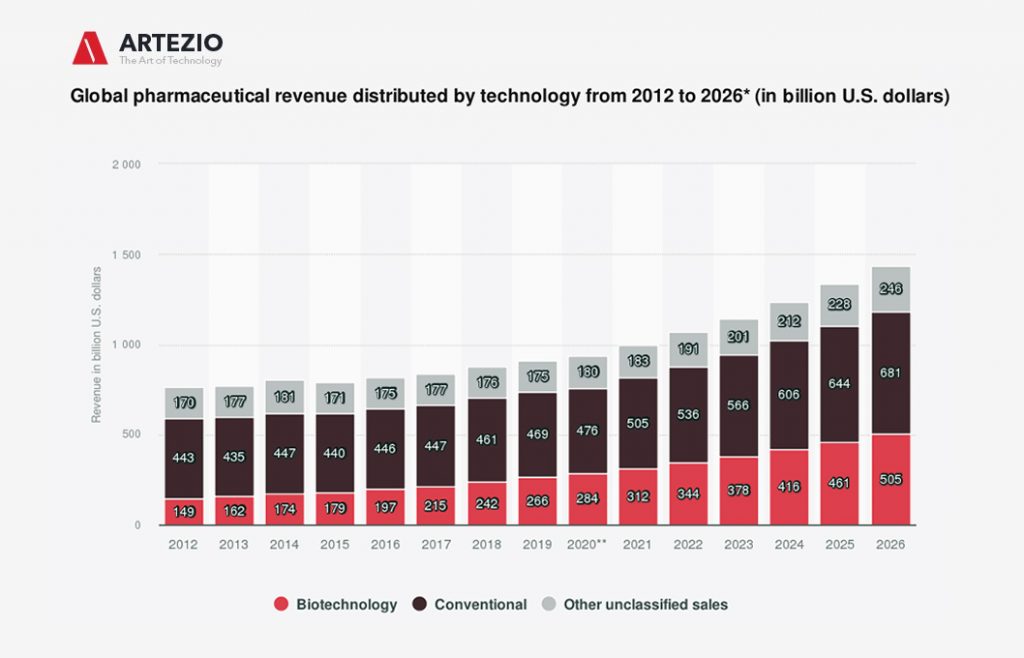

Global pharmaceutical revenue distributed by technology from 2012 to 2026

Here you can see the global pharmaceutical revenue – including prescription and over-the-counter drugs – from 2012 to 2026, categorized by technology.

In 2019, biotechnology accounted for 266 billion U.S. dollars in drug revenue, while conventional drugs accumulated 469 billion U.S. dollars, and unclassified technology accounted for 175 billion U.S. dollars of revenue. Biotechnology is used for the utilization of living systems and organisms to create pharmaceutical products. Synthetic humanized insulin, for instance, is widely used for the treatment of diabetes.

Spending on pharmaceutical industry R&D globally

Along with the growth of the Pharma market, the R&D didn’t stay in place. Spending on R&D and the introduction of new drugs have both increased in the past two decades significantly.

In 2020, research and development spending in the pharmaceutical industry stood at 188 billion U.S and forecasts predict an annual expenditure of around 200 billion U.S. dollars by 2022. By 2026, expenditures are expected to reach a total of over 230 billion U.S. dollars.

Pharmaceutical R&D includes all steps from the initial research of disease processes, the compound testing over pre-clinical, and all clinical trial stages. At a certain point in the process – mostly during the pre-clinical phase – a governmental authority is involved to overview, regulate, and ultimately approve the drug. At the beginning of 2021, there were 10,223 drugs in the pre-clinical phase of the R&D pipeline.

Product lifecycles in the pharmaceutical industry

Pharmaceutical manufacturers require time and money if they are to develop new innovative medicines: it can take 10 to 15 years to develop a new medicine, at an average cost of approximately 2.6 billion U.S. dollars.

Due to patents and exclusivity, brand-name drugs can expect to be on the market for an average of twelve years before a generic version enters. Generics contain the same active ingredients as branded drugs but can be considerably cheaper. The healthcare system in the United States generated around 313 billion U.S. dollars in savings through generic medicines in 2019.

From this, we can gather that the Pharma industry is an otherwise healthy and growing condition, given the ever more competitive landscape and power struggle among the major players on the market. However, what can we expect next?

Recent trends in the Pharma industry

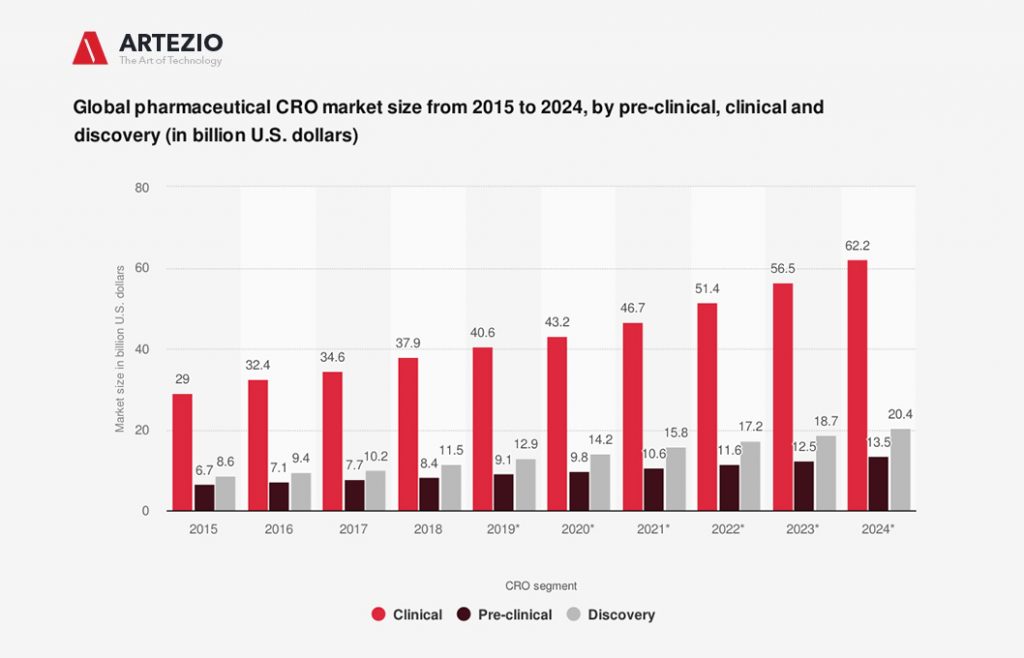

For the last several years, major developments in pharmaceutical research and development have begun to change the R&D landscape. A growing number of drug manufacturers are outsourcing large parts of R&D, mostly to clinical research organizations (also CROs), with the main aim to reduce costs.

By the year 2023, the size of the clinical segment in the global pharmaceutical CRO market was estimated to grow to 56.5 billion U.S. dollars.

On this graph, you can see the estimated global pharmaceutical CRO market size growth by pre-clinical, clinical, and discovery phase from 2015 to 2024, in billions of U.S. dollars.

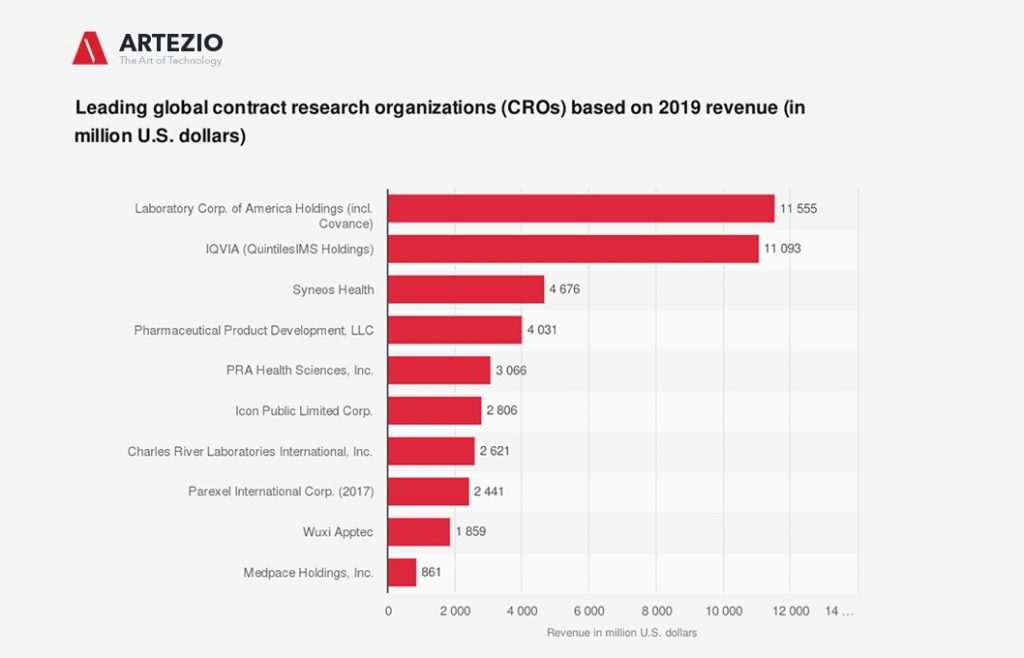

Leading global contract research organizations (CROs)

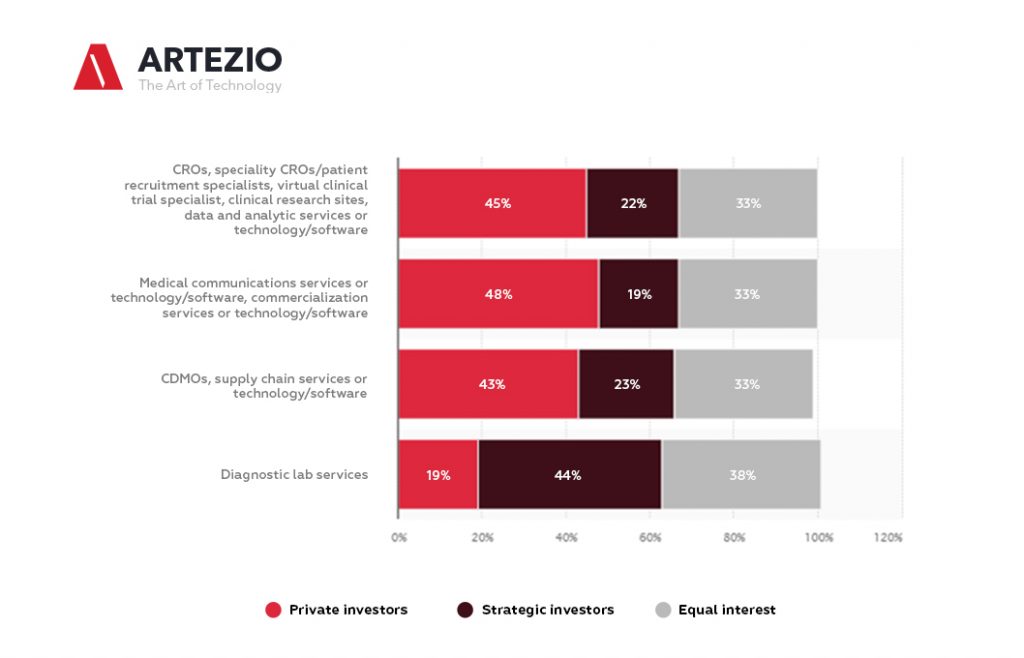

Here you can see the expected investment in biopharma and diagnostic lab services in 2021, by investment type.

On this statistic, you can see the illustration of the percentage of expected investment in biopharma services and diagnostic lab services in 2021, by type of investment. For the rest of 2021, surveyed U.S. investment professionals expect strategic investors to cover 48 percent of investments in diagnostic lab services.

Another important development is the use of big data in clinical research. Thus, predictive modeling is possible which uses clinical and molecular data to develop safer and more efficient drugs. Particularly, real-time or real-world evidence (RWE) is becoming a greater interest. This is a particularly interesting statistic for us, as the use of big data in Healthcare is one of Artezio’s key market directions.

According to the survey published by Deloitte, 60% of executives said that a better understanding of subpopulations and heterogeneity of treatment effects would be most impactful to current real-world evidence. This makes cooperation with technology companies necessary and includes data gathered from various sources, even that of social media.

Innovation is the key

More than most other industries, pharmaceutical companies are under pressure to develop new, innovative products. Time-limited patent protection of their products and the following threat of a sales slump through generic and similar competition are the major reasons why.

Accordingly, drug manufacturers must invest significant amounts into research and development. Compared to other industries, the pharmaceutical sector has by far the highest R&D expenditures per employee. With the increasing complexity of pharmaceutical R&D over the last two decades, the number of research collaborations is also clearly on the rise.

Which pharma company invests the most in R&D?

Among the largest pharmaceutical companies in the industries in 2020 were:

- Johnson & Johnson: $12.2 billion (14.8% of revenue)

- Roche: $6.5 billion (24.1% of revenue)

- Novartis: $9 billion (18.5% of revenue)

- Merck: $13.6 billion (28.3% of revenue)

- Pfizer: $9.4 billion (22.4% of revenue)

Some of the other major names in the industry include AstraZeneca, which spent $6 million in R&D compared to $26.6 million in revenue (22.6%), and Eli Lilly, which earned $24.5 billion in revenue and spent $6 billion in R&D (24.5%).

Swiss-based Roche is projected to spend nearly 13 billion U.S. dollars on pharmaceutical R&D. If this trend continues, by 2026, Roche will have the largest research and development spending among pharmaceutical companies. Other companies with high projected R&D expenditures are Merck, Novartis, and Johnson & Johnson.

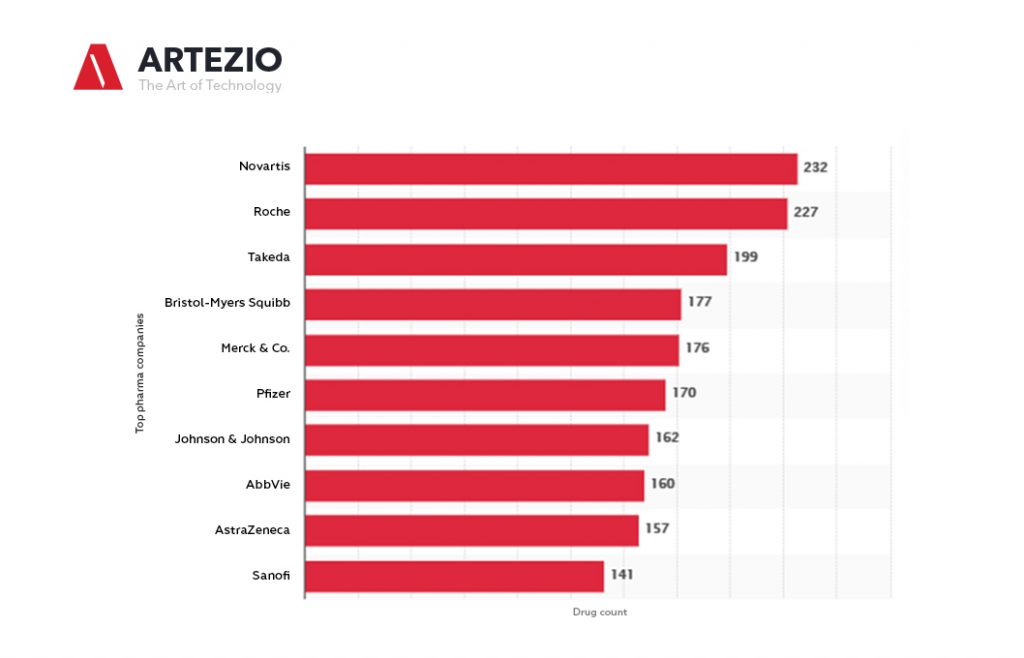

Top Pharma companies worldwide 2021, by the size of the R&D pipeline

In 2001, there were 1,198 pharmaceutical companies with active R&D pipelines, and this number increased up to over five thousand until January 2021.

When it comes to the development of new drugs, you can see that the Swiss-based company Novartis was the leader among the global top pharmaceutical companies, as of January 2021.

With 232 products in the 2021 R&D pipeline, Novartis leads the ranking, closely followed by another Swiss company, Roche, and by Japanese Takeda. Among the global top 10 companies based on products in the pipeline, five were from the United States.

How big is the clinical trials market?

According to GrandViewResearch, the global clinical trials market size is expected to reach USD 47.0 billion in 2021 with USD 69.3 billion revenue forecast in 2028.

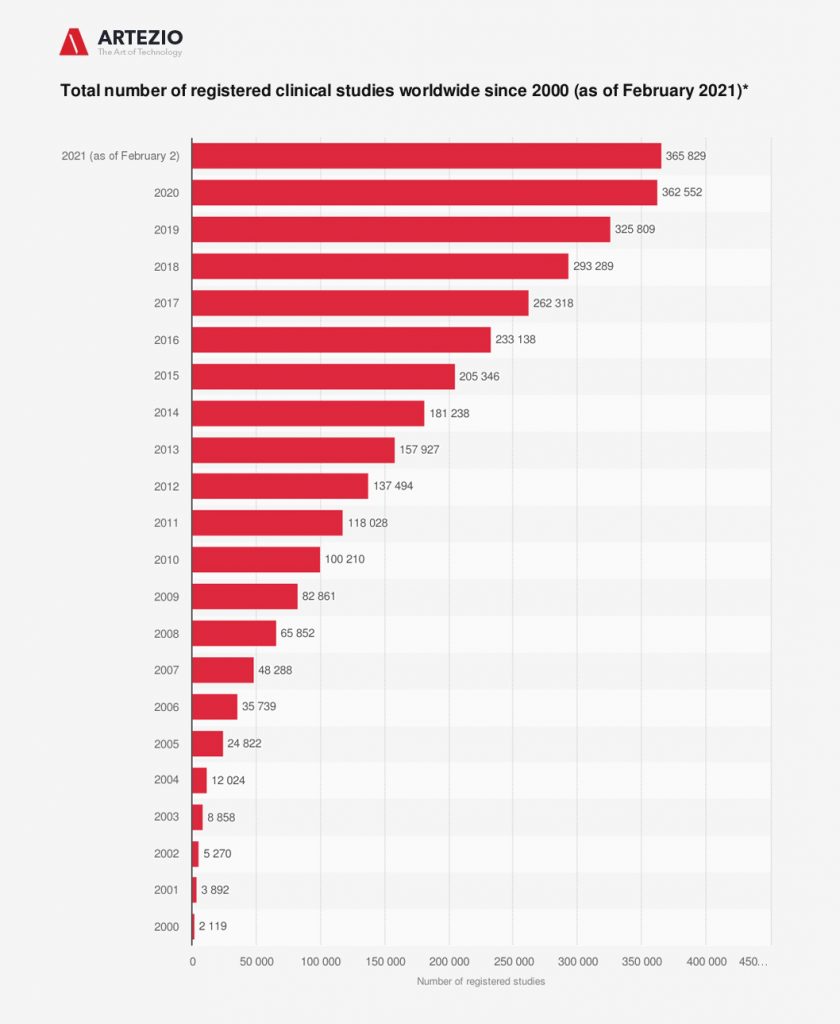

North America dominated the market for clinical trials and accounted for the largest revenue share of 51.0% in 2020. Registered clinical studies reached a number of over 365 thousand until early 2021.

On this graph, you can see clearly that the effect of COVID-19 has been enormous, with thousands of trials — around 80% of non-COVID-19 trials — being stopped or interrupted, according to Michael Lauer, deputy director for extramural research at the US National Institutes of Health. In addition, many high-risk and elderly groups stopped participation in clinical trials. In response, clinical researchers turned to a range of digital solutions to address the effects of the pandemic on trials. This, in turn, accelerated the adoption of decentralized trials, including digital health technologies such as wearables and other devices.

Many trials are currently taking place to find out if new or existing drugs can be safely used to treat patients with COVID-19 disease, or even better to find a vaccine. As of June 25, 2021, there were 1,228 drugs and vaccines in development targeting the coronavirus disease (COVID-19). American company ImmunoPrecise Antibodies and UK-based GlaxoSmithKline were ranked second among companies worldwide each with nine drugs/vaccines in development targeting COVID-19.

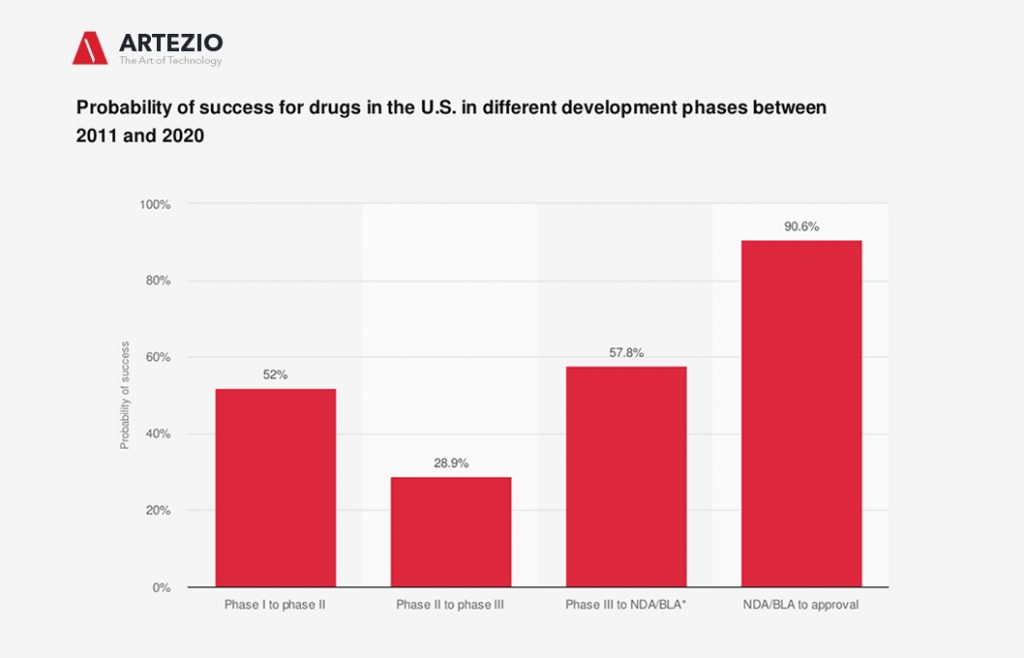

Receiving regulatory approval is the ultimate aim of pharmaceutical companies, but the probability of clinical trial success is relatively low.

Clinical studies globally

Most clinical studies occurring globally are held in countries outside of the U.S. The number of registered clinical studies in non-U.S. areas stood at some 184 thousand – or 50 percent of all studies worldwide.

Many clinical trials performed outside of the U.S. and EU are done so because it is often easier and cheaper to conduct trials in other locations. Success rates for clinical trials depend heavily on the stage of the trial and the drugs or products being developed. Recent data suggested that just 9.6 percent of drugs make it from phase I to approval.

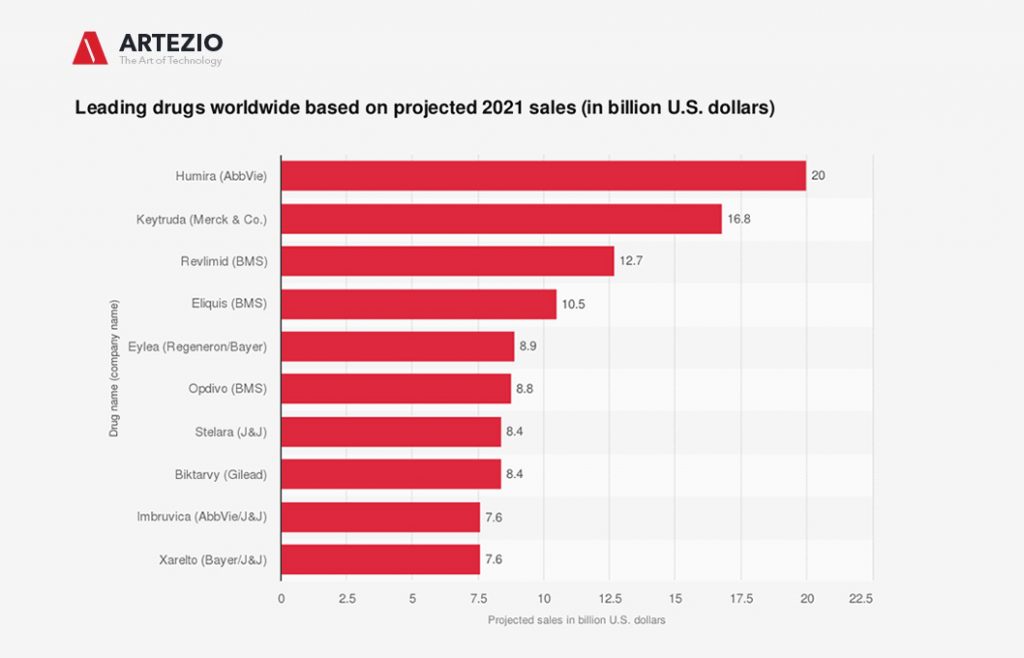

What is the top-selling drug in the world?

According to various sources, Keytruda is projected to be the second-ranked drug worldwide based on sales in 2021, with nearly 17 billion U.S. dollars. This statistic displays the expected top drugs in 2021 based on sales projections as of December 2020.

As of today, almost all of the world’s top revenue-generating drugs are derived from biotechnology and are part of the so-called large molecule drugs. AbbVie’s Humira and Roche’s Rituxan are among the top-selling biotechnology drugs in the world, generating 19.2 billion U.S. dollars and 7.1 billion U.S. dollars, respectively, in 2019.

One of the largest biotechnology companies in the world is headquartered in Basel, Switzerland. Roche generated some 41 billion U.S. dollars in biotech prescription drug revenues in 2019 and is expected to reach over 48 billion U.S. dollars in 2026. One of its top-selling drugs, Avastin, generated about 7.1 billion U.S. dollars in revenue in 2019. Avastin is a drug derived from biotechnology that is used to inhibit the growth of new blood vessels to treat some types of cancer.

The United States spent about 45 billion U.S. dollars on research and development in the biotechnology sector. The United States also had about 34 percent of the world’s share of filed biotechnology patents in 2014, in comparison, Germany filed eight percent of global biotech patents.

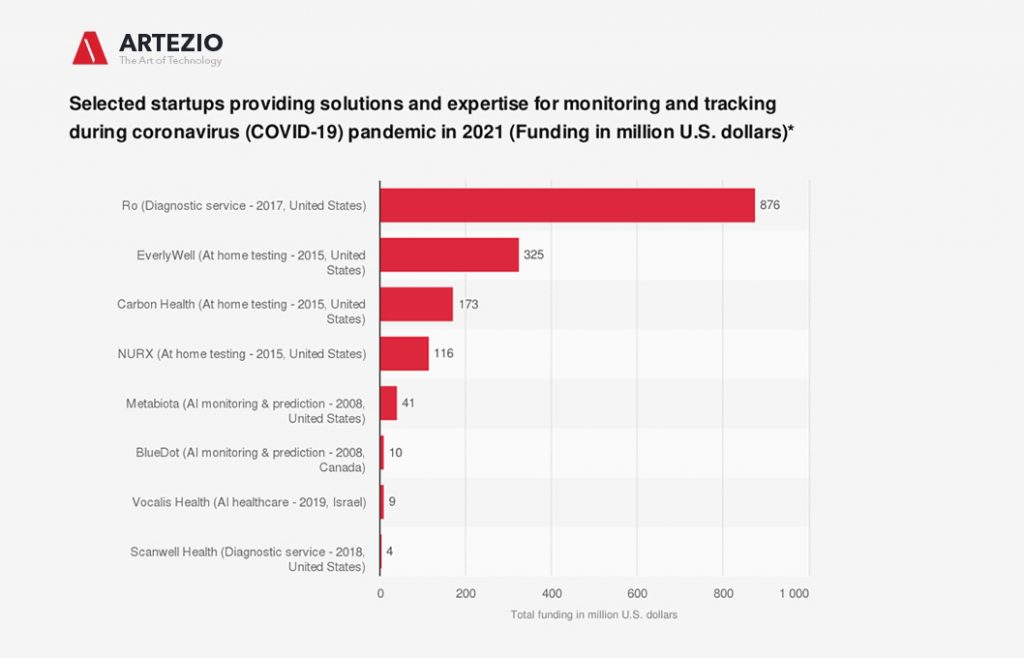

COVID-19 Startups

More and more startups from all sectors and industries are offering their help and expertise to combat the coronavirus pandemic.

On this graph, you can see some examples of these startups that offer solutions to monitor, track, and test the novel virus. The startups are ranked by their current funding amounts.

BlueDot

The Canadian startup uses machine learning to monitor outbreaks of infectious diseases worldwide. The company was able to detect the novel coronavirus (COVID-19) as early as late December and informed its clients on December 30, 2019, about an unusual amount of pneumonia cases in Wuhan, China. This was nine days before the World Health Organization officially flagged the disease as COVID-19. In the past BlueDot has been successful in predicting that the Zika virus would spread to Florida in 2016 and that the Ebola outbreak in 2014 would leave West Africa.

Metabiota

The artificial intelligence startup provides a database for infectious diseases and a model to detect and forecast high- and low-probability outbreaks and epidemics. The company created a near-term forecasting model of the coronavirus at the end of February, naming China, Japan, Italy, Iran, South Korea, Thailand, United States, Taiwan, Australia, and the Philippines as countries at risk.

NURX, Carbon Health, and EverlyWell

The three US-based startups from the healthcare services segment (telehealth, at-home testing, services) had started or planned to offer at-home test kits for COVID-19 through mail order in the United States. As of March 24, 2020, all of them have stopped offering the tests after a warning was issued from the Food and Drug Administration.

Ro

Ro is a direct-to-consumer healthcare technology company providing services such as online diagnosis and delivery of medication. The company has launched a free digital assessment for COVID-19. The service asks people about their symptoms and, if necessary, connects the user with a doctor for further consultation through a video call.

Scanwell Health

The California-based startup’s main offering is app-based testing and screening for urinary tract infections. It now has announced that it is working on an at-home COVID-19 diagnostic service and that it aims to make the service available in six to eight weeks (as of March 23, 2020).

Vocalis Health

The Israeli startup is exploring the possibility of using voice-based testing for detecting screening and monitoring COVID-19 symptoms. The company has developed a platform that utilizes artificial intelligence by using voice recordings for health monitoring. The goal is to potentially identify the unique vocal “fingerprint” of COVID-19.

Conclusion

Long story short, the pharmaceutical market keeps gaining momentum – has been for a while, and is very likely to keep going upwards at an unprecedented rate. More and more companies resort to digital solutions to boost up their research, clinical trials, and patient services, thus -creating fantastic opportunities to offer the nations worldwide a new quality of products or service delivery.

If there ever was a time to advance your health startup or add a digital service to the range of your clinic’s services, that time was yesterday. Today, however, is still good enough. Without proper data protection, HIPAA compliance, and other crucial Healthcare development nuances, such projects can present a significant challenge to complete. In order to create proper digital products, you will need a team that has successfully navigated the Healthcare IT projects from start to finish over the years, and Artezio is just that, with decades of experience and a whole army of seasoned development veterans available for project work.

Do get in contact with us to get a project structure and estimate of anything you have in mind, we’re always open for inquiries.

Recent Posts

- The Foundation Crisis: Why Hiring AI Specialists Before Data Engineers is Setting Companies Up for Failure

- ERP vs CRM vs Custom Platform: What Does Your Business Actually Need?

- The AI Enthusiasm Gap: Bridging Corporate Optimism with Public Skepticism in Enterprise AI Adoption

- The Future of AI-Powered Development: How Cursor Plans to Compete Against Tech Giants

- How Much Does Custom Software Development Cost in 2025? Real Numbers & Breakdown